We live in a world full of bubbles just waiting to pop.

We have reported extensively on the stock market bubble, the student loan bubble, and the auto bubble. We even told you about a shoe bubble. But there is one bubble that is bigger and potentially more threatening than any of these.

The massive debt bubble.

In a recent piece published by Business Insider, US Global Investors CEO Frank Holmes calls it “the mother of all bubbles.”

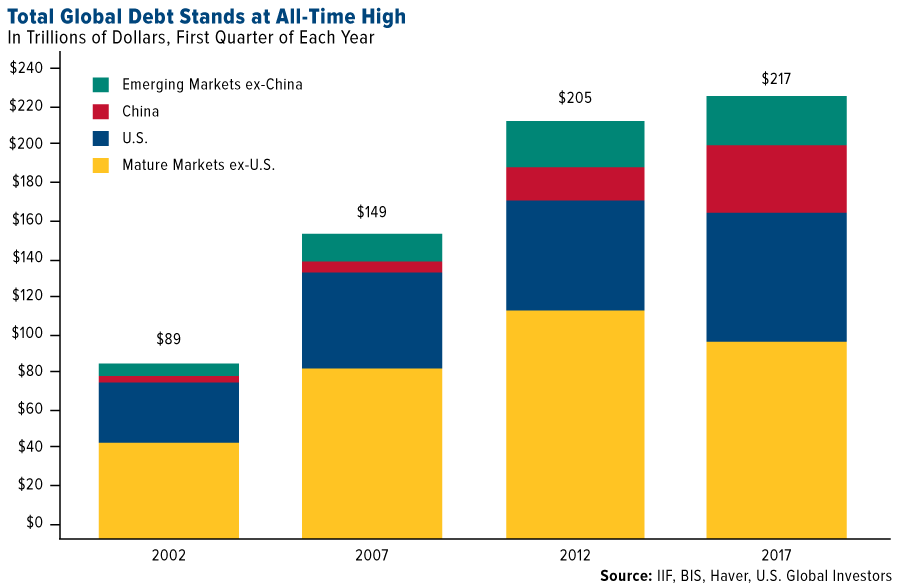

According to the Institute of International Finance (IIF), global debt levels reached a staggering $217 trillion in the first quarter of 2017. That represents 327% of global GDP. To put that into perspective, before the 2008 meltdown, global debt was a mere $150 trillion.

American families have amassed more than $1 trillion in credit card debt alone. As of the end of 2016, the average credit card debt per American household stood at $8,377. That was up from $7,893 at the end of 2015.

Everyday Americans aren’t the only ones racking up debt. They are simply following the example of their Uncle Sam. The US national debt has eclipsed $20 trillion, with actual unfunded liabilities pushing far higher.

China is also piling up debt at a torrid pace. Moody’s projects the Chinese government’s debt burden will rise to near 40% of GDP by 2018 and 45% by the end of the decade.

Holmes says this does not bode well for our economic future.

It goes without saying that this is a huge risk. Some are calling this mountain of debt ‘the mother of all bubbles,’ and we all remember how the last two bubbles ended, in 2000 (the tech or dotcom bubble) and 2007 (the housing bubble).”

Scotiabank released a note recently and expressed concern about all of this debt in a world of rising interest rates.

Higher interest rates are going to make the burden of refinancing the debt considerably heavier, and as more money goes into servicing the debt, it means less money is available to spend on other things, which could lead to less infrastructure spending and increased austerity.”

How in the world to you pay down so much debt? Realistically, you don’t. At some point, the bubble will burst.

In the midst of bubble world, Holmes says investors should buy gold, and called the yellow metal’s long-term investment case “bright.” He said if and when the mother of all bubbles pops, it could potentially spell trouble for the investor who hasn’t adequately prepared with some allocation in a safe haven.

Another crisis could be in the works. Savvy investors and savers might very well see this as a sign to allocate a part of their portfolios in ‘safe haven’ assets that have historically held their value in times of economic contraction. Gold is one such asset that’s been a good store of value in such times.”

Fonte: qui

Nessun commento:

Posta un commento